UPSTOCKS WEEKLY NEWSLETTER

Broad market analysis :

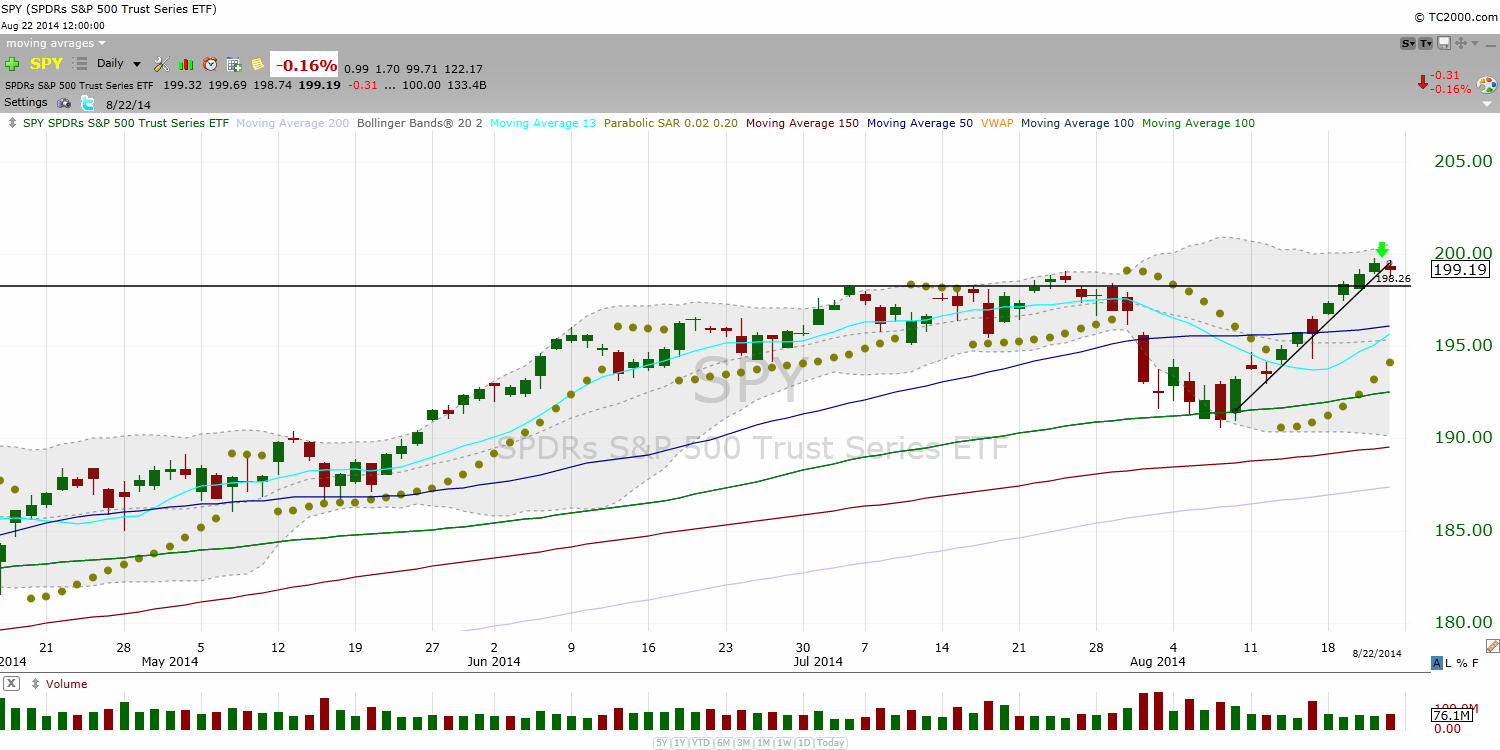

SPDR S&P 500 (SPY)

In the last report I wrote " The SPY managed to break the 194.41 level and close over its long-tern upward trend-line , from this point I'm expecting the SPY to test the 201 level as long as the SPY keep trending over the green trend-line (194.8) ".

The SPY kept up trending as expected testing the 199.76 level.

On Friday the price made a neutral to bearish price action as it made a spinning top with close lower than the open , we could see also a broken upward trend-line.

the SPY could pullback from here to re-test the 198.78 level. ( breaking this pivot the spy should pullback further to 198) , However breaking the 199.5 pivot will result further upward movement ( 201 as a target).

*The signal we got on Friday is neutral-slightly bearish .

IWM

In the last report I wrote " The IWM broke a downward trend-line as it started to respect the 13 SMA ( the aqua blue MV) as I'm expecting a test of the 115.28 as a target , Breaking that level it could form a triple top formation at 120.22."

The IWM is currently trending above its 100 and 150 SMA which is bullish as if it will keep finding support at the 114.36 level I would expect further upward movement and the 120.22 should be tested as it was stated last week.

Watch-list and Swing trades setups :

Swing trade setups :

ASTC

The price showing a possible accumulation in the last 2 days.

Entry : 2.95-3

Trigger : 3.09 ( breaking It )

Target : 3.3

POWR

The price is trending in an upward channel in case it break the upper channel it could spike and result a test of the 150 sma .

Entry : 11.5

Stop loss : under 11.23

Trigger : break of the 12.19 ( also as a first target)

Target : #1 14

VJET :

The price broke a downward trend-line .

Entry : 16.42 ( wait for a reversal)

Stop loss : under 16

Target : 18.20

*The price should pullback from here to 16.2 wait for a clear support and reversal.

Watch-last (day-trade) :

Evry :

( bounce off support

) - The stock has two potential supports from here - wait for clear support and reversal.

First support : 2.42 Second support : 2.33. ( which are also our entry in case we notice that one of these levels are providing support to the price) .

Trigger : 2.49

Target : 2.61

DGLY

(potential break-out ) : the price could have found support at the 7.72 level as in case it breaks 8.5 , it could spike much higher. (9.9 target)

Entry : 7.72-7.79

Stop loss : under 7.64

Trigger : 8.5 ( also as a first target )

Target : 9.9

CERU

(potential support play)

Entry : 4.49

Stop loss : under 4.4

#1 target : 4.84

CNET :

( potential support play) : the 150 SMA acting as support .

Entry : 1.04-1.05

Stop loss : under 1.02

trigger also as first target : 1.25 ( in case 1.25 will be broken the price could spike much higher.

USU

( setup was sent ) (22/8)

JRJC

Watch if the 9.51 pivot will act as support .

Entry : 9.51 ( wait for reversal)

Stop : under 9.3

Trigger : 10.74

Target :11.61.

HGSH

( bounce off support and potential break out) : watch if the 6.12 will act as support ( if not 5.5) as if the price break the 6.69 it could spike much higher .

Accumulation scanner :

OGXI : my scanner is noticing accumulation in these levels

CLSN : my scanner is noticing accumulation in thee levels

ALTI : my scanner is noticing accumulation in these levels

UURE : watch if the 2.9 breaks as the price could spike much higher.

Other stocks in our watch-list :

CERU : watch the 4.35 support .

HTBX : watch the 6.35 support .

HELI

DRL

The package includes :

Daily Watch List : Get detailed chart analysis, including exact entries, exits on swing trade and day trades and swing ideas

Live Trading Chatroom : Traders exchange ideas and receive UPstocks' real time alerts

Alerts : Real time Buy/Sell alerts in Live trading chat and sent directly to your Email

Accumulated Stocks Scanner Proprietary Scanner for penny stocks under accumulation before explosive move!!Swing

LIVE CHAT , LIVE ALERTS , LIVE CONSULTATION

ONLY 15$/Mo. ( $1.00 USD for the first 7 days )

CHECK THE BLOG FOR OUR PREVIOUS ACCUMULATION/SWING TRADES/DAY TRADING ALERTS

BETTER SITE COMING ON 5-10/9/2014

Nessun commento:

Posta un commento