stock market technical analysis :

SPDR S&P 500 (SPY)

Weekly

On 4th of April I wrote " In yesterdays post I was looking if the SPY will gap up and start selling breaking the lows of yesterday's session, which what actually happened, now I'm expecting a test of the 13 WMA , breaking that and it will probably sell to the 34 WMA as chart shows above" now after breaking the 13 WMA I'm still would be looking at a test of the 34 WMA.

Daily

as the daily chart shows above I'm looking for a test of the 184.44 .

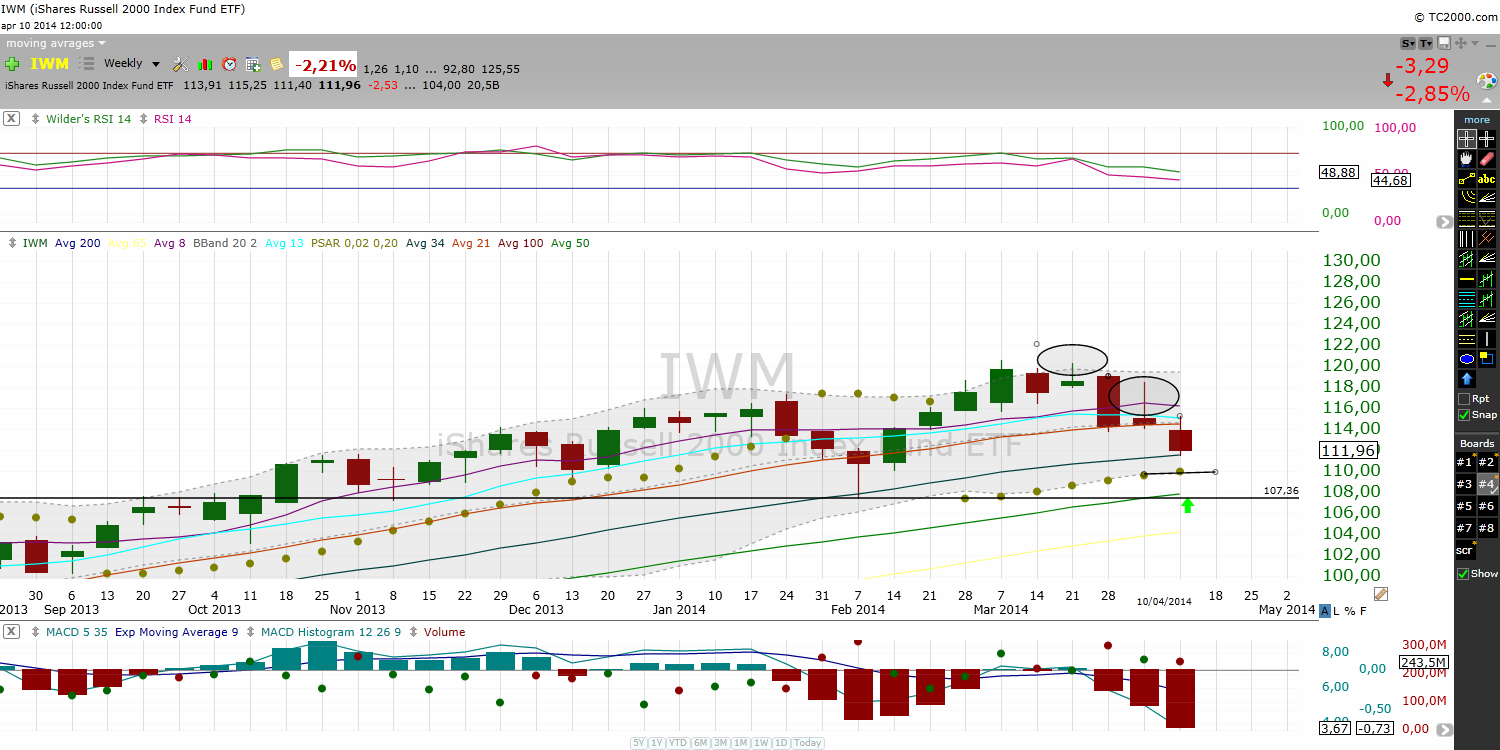

Shares Russell 2000 (IWM)

The weekly candle sticks are showing aggressive distribution bars as the chart shows above,

IWM tested the 13 WMA which confirm to me the selling pressure, I'm still expecting a test of the 107 level as i posted in the previous posts.

PowerShares QQQ (QQQ)

I posted last week that " QQQ broke a symmetrical triangle which could signal more downward movement .

I'm expecting that QQQ will sell to 83.80 and then I said " Currently The QQQ is trading bellow the 100 SMA which is bearish.

as I showed in the last update it broke a Symmetrical triangle which gives it a 83 price target, however it could be forming Descending broadening wedge which a short-term bullish reversal. there no martial change here and i'll be looking for the 83 to provide support.

For Real time alerts sent directly to your email Subscribe to our premium package !

Nessun commento:

Posta un commento